Solutions

Professional Accounting Services Nairobi.

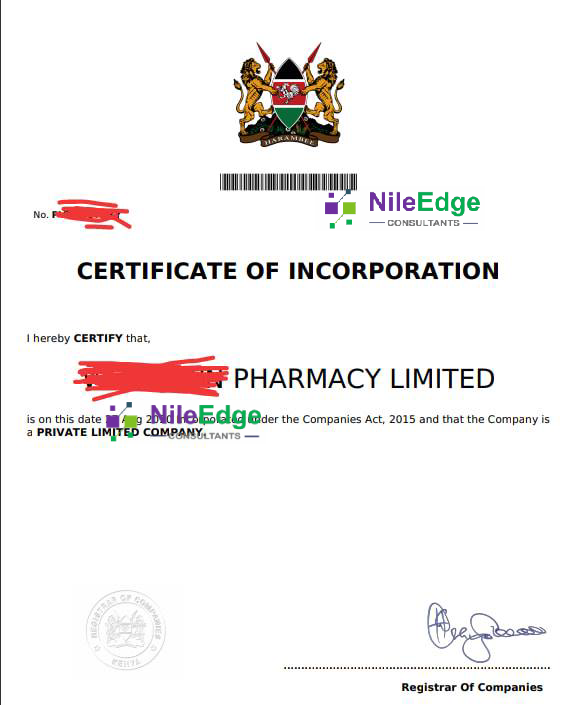

Nileedge Consultants offers expert accounting, bookkeeping, payroll, and tax services in Nairobi, Kenya. Ensure compliance and growth with our certified accountants.

Welcome to Nileedge Consultants – Your Trusted Accounting Partner in Nairobi

At Nileedge Consultants, we provide professional accounting services in Nairobi, Kenya for businesses of all sizes. Our team of qualified accountants specializes in bookkeeping, tax filing, payroll management, financial reporting, audit, and management accounting. We are committed to helping businesses maintain financial compliance, reduce tax risks, and make strategic decisions for growth.

Running a business in Nairobi comes with unique financial challenges. With the ever-changing Kenya Revenue Authority (KRA) regulations, VAT rules, and payroll requirements, having a reliable accounting partner is essential. Nileedge Consultants combines local expertise with international best practices to deliver accurate, efficient, and tailored accounting services.

Reasons to Get Accounting Services in Nairobi

Running a business in Nairobi comes with unique financial challenges. From navigating Kenya Revenue Authority (KRA) regulations to managing payroll and tax filings, handling finances in-house can be overwhelming. Hiring professional accounting services ensures your business remains compliant, financially organized, and positioned for growth. With the right accountants, Nairobi businesses gain expert advice, reduce errors, and make informed decisions that directly impact profitability and long-term success.

✅ Ensure Tax Compliance

Professional accountants in Nairobi help businesses comply with local tax regulations, including VAT, PAYE, and corporate taxes. This reduces the risk of penalties, fines, and audits from the Kenya Revenue Authority (KRA), ensuring your business stays on the right side of the law.

✅ Accurate Financial Record-Keeping

Proper bookkeeping is the backbone of any successful business. Accounting services maintain accurate financial records, track expenses, and manage accounts payable and receivable, giving you a clear view of your business finances.

✅ Save Time and Reduce Stress

Handling accounting tasks internally can be time-consuming and stressful. By outsourcing to professionals, business owners in Nairobi can focus on core operations and strategic growth rather than worrying about financial details.

✅ Expert Financial Advice

Accounting services provide expert insights into budgeting, cost management, and financial planning. Businesses benefit from informed decisions, improved cash flow management, and strategies to increase profitability.

✅ Streamline Payroll Management

Managing employee salaries, deductions, and benefits can be complex. Professional accounting services ensure timely and accurate payroll processing, keeping employees satisfied and ensuring compliance with statutory requirements like NSSF and NHIF.

✅ Prepare Accurate Financial Reports

Detailed financial reports, such as balance sheets, income statements, and cash flow reports, are essential for decision-making and securing funding. Accounting services in Nairobi provide tailored reports that reflect your business’s true financial health.

✅ Support During Audits

Audits can be stressful for businesses without proper financial records. Professional accountants prepare your books in compliance with local regulations, making audits smoother and less disruptive to operations.

✅ Cost-Effective Solutions

While hiring accountants involves an investment, the benefits—such as avoiding fines, improving efficiency, and optimizing taxes—often outweigh the costs. Outsourcing accounting services can be more cost-effective than maintaining an in-house team.

✅ Focus on Business Growth

With accounting handled by experts, Nairobi business owners can focus on expanding operations, launching new products, and increasing market share. Accurate financial insights allow businesses to make strategic growth decisions confidently.

Our Comprehensive Accounting Services in Nairobi

Our comprehensive accounting services in Nairobi are designed to help businesses and individuals manage their finances efficiently, stay tax-compliant, and make informed financial decisions. From bookkeeping, tax planning, and payroll management to financial reporting and advisory services, we provide tailored solutions that suit every business size. Partnering with our expert accountants ensures accuracy, transparency, and growth, making us the preferred choice for professional accounting services in Nairobi.

Efficient bookkeeping is the backbone of any successful business, and our professional bookkeeping services in Nairobi ensure your financial records are accurate, organized, and up-to-date. Whether you run a small business, a startup, or a large company, our expert accountants handle daily transactions, ledger management, bank reconciliations, and financial statements with precision. With our reliable accounting and bookkeeping services in Nairobi, you gain clear insights into your business’s financial health, enabling better decision-making and strategic planning. We use modern accounting software and best practices to reduce errors and streamline your financial processes. From tracking expenses and managing invoices to preparing reports for audits and tax compliance, our Nairobi bookkeeping solutions are tailored to meet your specific business needs. Partner with us to save time, minimize financial risks, and focus on growing your business while we take care of all your bookkeeping and accounting needs professionally.

Navigating tax regulations can be complex, but our expert tax preparation and filing services in Nairobi make it simple, accurate, and stress-free. We help businesses and individuals comply with Kenya Revenue Authority (KRA) requirements while optimizing tax efficiency. Our services include preparing and filing corporate tax returns, individual income taxes, VAT, and PAYE, ensuring timely submissions and minimizing penalties. With our professional accounting and tax services in Nairobi, you gain personalized guidance to identify allowable deductions, plan for tax liabilities, and maintain full compliance with local tax laws. We stay updated on the latest tax changes in Kenya to provide accurate advice and strategic tax planning. By partnering with us, you reduce the risk of errors, avoid unnecessary audits, and keep your finances organized. Trust our reliable tax services in Nairobi to handle all your tax preparation, filing, and advisory needs while you focus on growing your business.

Managing payroll can be time-consuming and complex, but our professional payroll management services in Nairobi streamline the process for businesses of all sizes. We handle salary calculations, statutory deductions, PAYE, NHIF, NSSF contributions, and timely salary disbursements with accuracy and confidentiality. Our expert team ensures your company complies with all Kenyan labor laws and tax regulations, minimizing risks and avoiding penalties. With our reliable accounting and payroll services in Nairobi, you gain customized solutions that fit your business structure, whether you operate a startup, SME, or large enterprise. We also provide detailed payroll reports, payslips, and records for audits or management review, saving you time and reducing administrative burden. By outsourcing your payroll to us, you ensure employees are paid correctly and on time, boosting morale and productivity. Trust our Nairobi payroll solutions for seamless, compliant, and efficient payroll management tailored to your business needs.

Accurate financial reporting is essential for informed business decisions, and our financial reporting and analysis services in Nairobi provide clear, reliable insights into your company’s performance. We prepare comprehensive financial statements, including balance sheets, income statements, and cash flow reports, tailored to meet local regulatory standards and your business needs. Our expert accountants analyze data to identify trends, measure profitability, and assess financial health, helping businesses make strategic decisions and plan for sustainable growth. With our professional accounting and financial reporting services in Nairobi, you can track performance, monitor expenses, and optimize resource allocation with confidence. We also support audit preparation, investor reporting, and compliance with Kenya’s financial regulations. By leveraging our Nairobi financial reporting solutions, business owners and managers gain actionable intelligence, minimize risks, and strengthen stakeholder trust. Partner with us to transform your raw financial data into clear, actionable insights that drive success and growth.

Ensure transparency, accuracy, and compliance with our professional audit and assurance services in Nairobi. Our expert auditors help businesses, nonprofits, and individuals verify financial statements, internal controls, and regulatory compliance to build stakeholder confidence. We conduct thorough audits, including statutory audits, internal audits, and specialized assurance engagements, tailored to your organization’s size and industry. With our accounting and audit services in Nairobi, you gain independent verification of your financial records, helping detect errors, prevent fraud, and enhance operational efficiency. Our team provides detailed audit reports, recommendations, and actionable insights to improve financial processes and governance. By partnering with us for Nairobi audit solutions, you meet Kenya Revenue Authority (KRA) and regulatory requirements, strengthen credibility with investors and partners, and support strategic decision-making. Trust our reliable audit and assurance services to safeguard your business, maintain compliance, and promote confidence among stakeholders while ensuring your financial integrity.

Our professional management accounting services in Nairobi help businesses make strategic decisions by providing detailed financial insights and performance analysis. We focus on budgeting, forecasting, cost analysis, and financial planning to guide management in improving efficiency and profitability. With our expert accounting and management accounting services in Nairobi, you gain tailored solutions that align with your business goals, track key performance indicators, and optimize resource allocation. Our team prepares management reports, variance analysis, and financial models to support informed decision-making, risk management, and long-term growth strategies. Whether you run a small enterprise or a large corporation, our Nairobi management accounting solutions provide actionable intelligence to enhance operational performance and maximize returns. By partnering with us, businesses can make data-driven decisions, improve internal controls, and strengthen financial governance. Trust our management accounting expertise in Nairobi to turn financial data into strategic insights that drive sustainable business success.

Professional Accounting Services in Nairobi – Our Proven Process for Businesses

Our comprehensive process for accounting services in Nairobi is designed to guide businesses from understanding their financial needs to achieving full compliance and optimized performance. We begin with an initial consultation to discuss your business goals and identify financial challenges, followed by a thorough assessment of existing systems and records to pinpoint gaps and improvement opportunities. Next, we create a customized plan tailored to your business, covering bookkeeping, payroll, tax, and financial reporting. During implementation, we set up and integrate all accounting systems, ensuring seamless operations. We then provide ongoing support with continuous monitoring, reporting, and expert advice to keep your finances organized and compliant. Finally, we optimize performance by analyzing results and adjusting strategies, giving Nairobi businesses actionable insights to maximize profitability, reduce risks, and grow sustainably with reliable, professional accounting services.

Step 1: Initial Consultation

We discuss your business goals, financial challenges, and requirements to design personalized accounting services in Nairobi that fit perfectly.

Step 2: Assessment:

Review current financial records, systems, and processes to identify gaps and opportunities for efficient accounting services in Nairobi.

Step 3: Customized Plan:

Develop tailored accounting solutions addressing bookkeeping, tax, payroll, and reporting needs for optimal financial management in Nairobi.

Step 4: Implementation:

Set up and integrate bookkeeping, payroll, tax, and financial reporting systems, ensuring smooth operations across your Nairobi-based business.

Step 5: Ongoing Support:

Provide continuous monitoring, guidance, and reporting, helping Nairobi businesses stay compliant and improve financial performance efficiently.

Step 6: Performance Optimization:

Analyze results, adjust strategies, and offer actionable insights to maximize profitability and effectiveness of your accounting services in Nairobi.

Common Accounting Challenges in Nairobi and How to Solve Them.

Running a business in Nairobi comes with financial challenges that can affect growth, compliance, and profitability. Our professional accounting services Nairobi are designed to help businesses overcome common issues such as inaccurate bookkeeping, tax compliance difficulties, payroll errors, cash flow management, delayed financial reporting, and risks of fraud or mismanagement. By partnering with expert accountants, Nairobi businesses can implement reliable systems, streamline financial processes, and ensure timely reporting. Our services provide tailored solutions for bookkeeping, payroll, tax filing, and financial analysis, enabling business owners to make informed decisions, minimize risks, and focus on growth. With trusted accounting services in Nairobi, companies can maintain transparency, stay compliant with KRA regulations, optimize cash flow, and enhance overall financial performance for long-term success.

-

Inaccurate Bookkeeping:

Poor record-keeping can lead to errors and compliance issues. Using professional accounting services Nairobi, implement reliable bookkeeping systems and regular reconciliations to ensure accurate financial records.

Inaccurate Bookkeeping:

Poor record-keeping can lead to errors and compliance issues. Using professional accounting services Nairobi, implement reliable bookkeeping systems and regular reconciliations to ensure accurate financial records. -

Tax Compliance Issues:

Businesses often struggle with KRA regulations. Expert accounting services Nairobi provide timely tax filing, deductions management, and guidance to remain fully compliant and avoid penalties.

Tax Compliance Issues:

Businesses often struggle with KRA regulations. Expert accounting services Nairobi provide timely tax filing, deductions management, and guidance to remain fully compliant and avoid penalties. -

Cash Flow Management:

Managing cash flow is a common challenge. With accounting services Nairobi, businesses can monitor inflows, plan expenses, and maintain liquidity to ensure smooth operations.

Cash Flow Management:

Managing cash flow is a common challenge. With accounting services Nairobi, businesses can monitor inflows, plan expenses, and maintain liquidity to ensure smooth operations. -

Payroll Errors:

Mistakes in salaries or statutory deductions can harm morale. Professional accounting services Nairobi ensure accurate payroll processing and adherence to Kenyan labor laws.

Payroll Errors:

Mistakes in salaries or statutory deductions can harm morale. Professional accounting services Nairobi ensure accurate payroll processing and adherence to Kenyan labor laws. -

Financial Reporting Delays:

Delayed reports affect decision-making. Outsourcing to accounting services Nairobi guarantees timely, accurate financial statements for audits, planning, and management review.

Financial Reporting Delays:

Delayed reports affect decision-making. Outsourcing to accounting services Nairobi guarantees timely, accurate financial statements for audits, planning, and management review. -

Fraud and Mismanagement Risks:

Internal fraud can damage a business. Rely on accounting services Nairobi to implement internal controls, audits, and monitoring systems to safeguard assets and maintain transparency.

Fraud and Mismanagement Risks:

Internal fraud can damage a business. Rely on accounting services Nairobi to implement internal controls, audits, and monitoring systems to safeguard assets and maintain transparency.

Cost Breakdown of Accounting Services in Nairobi

Understanding the cost of professional accounting services in Nairobi is essential for businesses planning their budgets. Fees typically depend on the scope of services, business size, complexity, and frequency of accounting tasks.

1. Bookkeeping Services:

Bookkeeping fees vary based on the volume of transactions and frequency of reporting. Small businesses may pay a monthly retainer for basic bookkeeping, while larger companies with high transaction volumes might require daily or weekly services, increasing the cost.

2. Tax Preparation and Filing:

Costs for tax services depend on the number and type of returns, complexity of tax matters, and additional advisory needs. Corporate tax filings, VAT, PAYE, and individual returns are priced according to the workload and level of expertise required.

3. Payroll Management:

Payroll service charges are often based on the number of employees and the frequency of payroll processing. More employees or complex payroll structures, including statutory deductions and benefits management, can affect the overall cost.

4. Financial Reporting and Analysis:

Financial statement preparation, performance analysis, and variance reporting may be billed as monthly, quarterly, or annual services. Comprehensive analysis adds value but comes at a higher investment.

5. Audit and Assurance Services:

Audit fees depend on company size, transaction complexity, and regulatory requirements. Larger organizations or those requiring detailed compliance checks may face higher costs.

6. Management Accounting and Advisory Services:

Strategic financial planning, budgeting, forecasting, and advisory services are customized based on business needs. Pricing varies according to project scope, complexity, and frequency of consultations.

Partnering with experienced accounting services in Nairobi ensures transparency and value for money. Our team provides a clear cost breakdown upfront, helping businesses budget effectively while receiving professional, reliable, and efficient accounting support tailored to their unique needs.

Why Choose NileEdge Consultants for Accounting Services in Nairobi

Partner with NileEdge Consultants for professional accounting services in Nairobi. Benefit from local expertise, experienced accountants, tailored solutions, compliance assurance, and timely delivery for your business growth.

Deep Local Expertise in Nairobi

Our team at NileEdge Consultants offers unmatched local expertise in accounting services Nairobi, understanding the city’s dynamic business environment and Kenyan accounting regulations. This insight allows us to provide solutions that are relevant, practical, and fully compliant with local laws. We help businesses navigate challenges unique to Nairobi, including KRA requirements, VAT management, and sector-specific financial reporting. By leveraging our knowledge of local business practices and regulatory frameworks, your company benefits from accurate, efficient, and strategic accounting services that support growth, reduce risks, and maintain financial transparency in all operations across Nairobi.

Certified and Experienced Accounting Professionals

NileEdge Consultants’ team consists of highly qualified, certified accountants with extensive experience in delivering professional accounting services in Nairobi. Our experts are skilled in bookkeeping, tax filing, payroll management, audits, and financial reporting for businesses of all sizes. Their experience ensures precision, adherence to regulations, and actionable financial insights. With a team that understands both local and international accounting standards, we provide reliable solutions, minimize errors, and enhance decision-making. Businesses can trust our accountants to manage complex financial operations efficiently, ensuring compliance and strategic growth while benefiting from professional guidance tailored specifically to Nairobi-based enterprises.

Customized Accounting Solutions in Nairobi

We provide tailored accounting services in Nairobi designed to match your business size, industry, and operational needs. From startups to established enterprises, our solutions cover bookkeeping, tax planning, payroll, audits, and financial reporting. By customizing our services, we ensure efficiency, accuracy, and relevance, addressing each client’s unique challenges. NileEdge Consultants works closely with businesses to implement systems and processes that streamline financial management, improve performance, and support informed decision-making. Our tailored approach ensures that Nairobi businesses receive personalized attention, scalable solutions, and a cost-effective accounting strategy that aligns with their goals and maximizes profitability.

Ensuring Full Compliance

Staying compliant with Kenyan tax and accounting regulations is critical. Our accounting services in Nairobi guarantee full alignment with KRA requirements, VAT, PAYE, and other statutory obligations. NileEdge Consultants helps businesses navigate complex rules, avoiding penalties, errors, and audits. Our team continuously monitors changes in accounting laws to ensure clients remain up-to-date. Compliance assurance covers financial reporting, payroll, tax filings, and internal controls, providing peace of mind and protecting your company’s reputation. By partnering with us, Nairobi businesses can operate confidently, knowing that all statutory requirements are met professionally and efficiently, minimizing risks and safeguarding financial integrity.

Reliable and Timely Accounting Services in Nairobi

We understand that timely financial information is essential for strategic decision-making. NileEdge Consultants ensures that all accounting services in Nairobi—from bookkeeping to tax filing and financial reporting—are delivered within agreed deadlines. Our team uses efficient processes, modern accounting software, and best practices to maintain punctuality without compromising accuracy. Timely delivery allows businesses to plan effectively, meet regulatory deadlines, and respond promptly to market opportunities. By relying on our services, Nairobi companies gain consistent, reliable, and punctual accounting support, ensuring financial operations run smoothly and enabling management to focus on growth and business expansion confidently.

Other Services We Offer

Frequently Asked Questions - Accounting Services in Nairobi

Find answers to the most common questions about professional accounting services in Nairobi. Learn about bookkeeping, tax filing, payroll management, compliance, audits, and advisory solutions to help Nairobi businesses stay organized, compliant, and financially efficient with expert guidance.

What are the main accounting services offered in Nairobi?

Nairobi businesses can access a wide range of professional accounting services, including bookkeeping, tax preparation and filing, payroll management, financial reporting and analysis, audit and assurance, management accounting, and financial advisory services. These services are designed to help companies stay compliant, organized, and financially efficient while supporting strategic decision-making.

Why should my business hire professional accounting services in Nairobi?

Hiring professional accounting services in Nairobi ensures accuracy in financial records, compliance with KRA regulations, timely tax filings, and effective payroll management. Expert accountants provide strategic advice, risk management, and detailed reporting, allowing business owners to focus on growth while minimizing errors, penalties, and financial mismanagement.

How much do accounting services in Nairobi cost?

Costs vary depending on service type, business size, transaction volume, and complexity. Bookkeeping, payroll, tax filing, audits, and advisory services have different pricing models. Nairobi businesses can choose tailored packages based on their requirements, ensuring value for money while receiving accurate, compliant, and professional accounting support.

Can you handle tax preparation and filing for Nairobi businesses?

Yes, expert accounting services in Nairobi handle corporate and individual tax returns, VAT, PAYE, and other statutory requirements. We ensure timely submission, identify deductions, optimize tax liabilities, and maintain full compliance with Kenyan tax laws, reducing the risk of penalties or audits.

Do you provide payroll management for Nairobi companies?

Absolutely. Our payroll management services in Nairobi include calculating salaries, statutory deductions like NHIF and NSSF, PAYE compliance, generating payslips, and timely salary disbursement. We ensure accuracy, confidentiality, and compliance with Kenyan labor regulations while simplifying payroll processes for businesses.

How do you ensure compliance with Kenyan accounting standards?

We continuously monitor changes in KRA regulations, VAT laws, and other statutory requirements. Our accounting services in Nairobi implement internal controls, timely reporting, and audit-ready processes to ensure all financial records meet legal standards, safeguarding businesses from penalties and enhancing credibility with stakeholders.

Can small businesses benefit from accounting services in Nairobi?

Yes. Small businesses in Nairobi gain efficiency, accuracy, and financial clarity by outsourcing accounting tasks. Professional services streamline bookkeeping, tax filing, payroll, and reporting, providing insights for growth and sustainability. Tailored solutions make these services affordable and scalable to suit small business needs.

What makes NileEdge Consultants different from other accounting firms in Nairobi?

NileEdge Consultants combines local expertise, certified professionals, tailored solutions, compliance assurance, and timely delivery. We understand Nairobi’s business environment, provide customized strategies, ensure KRA compliance, and deliver accurate financial reports. Our services are designed to support businesses of all sizes efficiently and reliably.

How often should financial reports be prepared by accounting services in Nairobi?

Financial reporting frequency depends on business needs, regulatory requirements, and management goals. Monthly or quarterly reports are common for tracking performance, while annual reports are necessary for audits and tax compliance. Accounting services in Nairobi tailor reporting schedules to provide timely insights for effective decision-making.

Can accounting services in Nairobi help with business growth strategies?

Yes. Beyond compliance, professional accounting services in Nairobi provide management accounting, financial analysis, and advisory solutions. By evaluating performance, cash flow, and profitability, businesses receive actionable insights and strategic recommendations that support informed decision-making, risk management, and sustainable growth in Nairobi’s competitive market.