Solutions

Company Registration in Kenya

Start your business the right way with fast, affordable company registration in Kenya. Learn the requirements, process, and benefits for sole proprietorships, partnerships, limited companies, NGOs, and more.

Register Your company Today with NileEdge Consultants Ltd.

Are you planning to start a business and looking for company registration in Kenya? NileEdge Consultants Ltd is here to make the process smooth, fast, and affordable.

Registering your company is the first step towards building a successful venture in Kenya. Whether you’re a Kenyan entrepreneur, a startup founder, or an international investor, you’ll need to comply with the Kenyan Companies Act 2015 to legally operate your business.

At NileEdge Consultants Ltd, we specialize in company registration services in Kenya, taking care of all the paperwork, compliance, and government filings so you can focus on your vision.

Why Register a Company in Kenya?

Kenya is East Africa’s commercial hub with a rapidly growing economy, stable political environment, and a strategic location. When you register your company in Kenya, you gain:

✅ Legal Recognition

Your business becomes a separate legal entity, protecting your personal assets.

✅ Intellectual Property

Your company name is reserved and legally protected.

✅ Investor Confidence

Registered businesses attract partners and investors more easily.

✅ Access to Opportunities

Many government and private contracts are only available to registered businesses.

✅ Banking and Financing

Easily open corporate bank accounts and access credit facilities.

✅ Tax Compliance & Incentives

Benefit from structured tax systems and certain government incentives.

Choosing the Right Business Structure in Kenya

Selecting the proper legal structure is fundamental to your company’s success and future scalability. Consulting experts like NileEdge Consultants can help you determine the best structure based on your business goals, tax considerations, and operational plans. Here are the main types of business entities registered in Kenya:

A Limited Liability Company (LLC) is the preferred structure for company registration in Kenya, offering limited liability protection and operating as a separate legal entity. The registration process is done online, making company registration in Kenya faster and more efficient.

To register an LLC, you need at least one director, a reserved company name, a Memorandum and Articles of Association, valid KRA PINs and IDs for directors and shareholders, and a registered office address. The required forms—CR1, CR2, CR8, and a statement of nominal capital—are submitted to the Registrar of Companies.

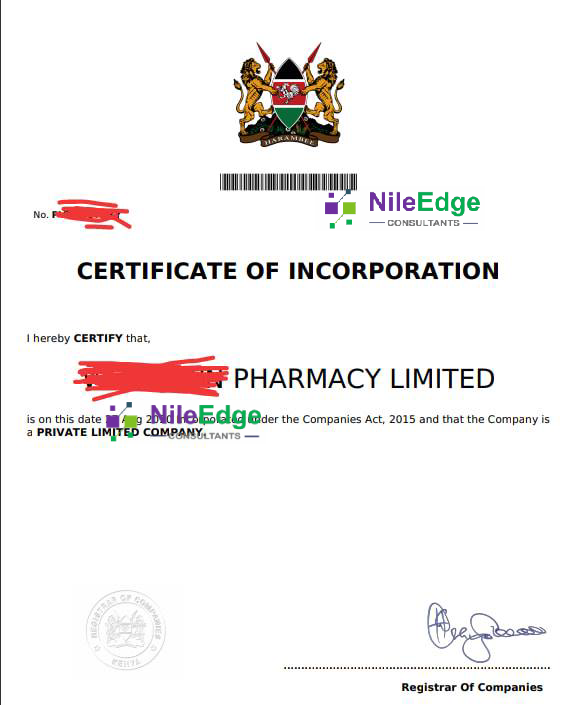

Once approved, the company receives a Certificate of Incorporation, completing the company registration in Kenya process. For official guidelines and updates, visit the Kenya eCitizen Portal and the Registrar of Companies. Our service simplifies this entire process, helping you register your company smoothly and confidently.

Choosing the right business structure and ensuring compliance with all legal requirements is crucial for long-term success. With our expert guidance, you can navigate company registration in Kenya without hassle, focusing on growing your business while we handle the paperwork.

A Public Limited Company (PLC) is ideal for businesses seeking to raise large-scale capital through public share offerings and stock exchange listing. If you’re considering company registration in Kenya, a PLC offers enhanced growth opportunities and credibility through transparency and regulatory compliance.

A PLC operates as a separate legal entity, with shares available to the public. It requires at least two directors and seven shareholders and must follow stricter disclosure rules under the Companies Act, 2015, and oversight by the Capital Markets Authority (CMA) if listed.

Company registration in Kenya for a PLC involves reserving a company name, preparing the Memorandum and Articles of Association, submitting forms CR1, CR2, CR6, CR8, and a capital declaration via the eCitizen portal. Directors and shareholders must provide valid KRA PINs and identification, along with a registered office address.

Once approved, the Registrar issues a Certificate of Incorporation. For official guidelines, visit the Kenya eCitizen Portal and Capital Markets Authority. Our service helps you navigate the process smoothly and confidently.

Sole proprietorship registration in Kenya is the fastest and most affordable option for company registration in Kenya, perfect for small entrepreneurs seeking a simple way to start legally. Unlike companies, a sole proprietorship is owned and managed by one person and does not have a separate legal identity, meaning the owner is personally liable for business debts.

To register a sole proprietorship, you must choose a unique business name, provide a valid Kenyan National ID or passport, a KRA PIN certificate, and a physical business address. The registration is completed online through the eCitizen portal, with a fee of about Ksh 1,000.

Once registered, you receive a Business Name Certificate, enabling you to trade legally in Kenya. While simple, this structure offers no liability protection, so many sole proprietors upgrade to companies as their business grows.

For official details and to begin company registration in Kenya, visit the eCitizen Portal. Our service supports you throughout the process to ensure hassle-free registration and compliance.

Partnership registration in Kenya is a flexible and straightforward option for entrepreneurs who want to start a business with friends, family, or colleagues. When considering company registration in Kenya, registering a partnership offers a practical way to formalize your business without complex procedures.

A partnership involves two or more individuals sharing ownership, profits, and liabilities. Unlike limited companies, partnerships are not separate legal entities, so partners are personally liable for business debts. This structure suits professional firms, small businesses, and startups.

To register a partnership, you need a unique business name, at least two partners, valid IDs, KRA PINs, a physical business address, and payment of a registration fee via the eCitizen portal. Although a signed partnership deed is recommended, it’s not mandatory.

Once approved, the Registrar issues a Partnership Registration Certificate. For official info and to start your company registration in Kenya, visit the eCitizen Portal. Our service guides you through every step for smooth registration.

Registering a branch of a foreign company in Kenya is an effective way for international businesses to enter the Kenyan market without creating a separate legal entity. When considering company registration in Kenya, understanding the process for foreign branch registration is essential for smooth operations.

A foreign branch operates as an extension of the parent company and is fully liable for its activities in Kenya. Unlike subsidiaries, branches do not have their own share capital.

To register a foreign company branch via the eCitizen portal, you need certified copies of the parent company’s incorporation documents, a notarized resolution to open the branch, the branch’s physical address, identification of the branch manager, a KRA PIN for the branch, and payment of fees.

Once approved, the Registrar issues a Certificate of Registration of Foreign Company. For official guidance, visit the eCitizen Portal. Our service ensures a hassle-free foreign branch registration experience.

If you want to start a nonprofit focused on social causes or community development, NGO registration in Kenya is essential for legal recognition and credibility. While different from typical company registration in Kenya, understanding NGO registration helps ensure your organization operates transparently and within the law.

An NGO is a nonprofit entity serving social, environmental, humanitarian, or advocacy goals. In Kenya, NGOs are registered under the Non-Governmental Organizations Coordination Act or as companies limited by guarantee under the Companies Act.

To register an NGO, you must choose a unique name, prepare a constitution or memorandum and articles of association, and identify at least seven members or trustees. Valid identification and contact details for all members are required, along with a physical address.

Applications and fees are submitted to the NGO Coordination Board or Companies Registry. After review, a Certificate of Registration is issued. For official guidance, visit the NGO Coordination Board and eCitizen Portal. Our service helps you navigate this process smoothly.

Registering a church in Kenya is crucial for legal recognition and official operation. Although church registration differs from typical company registration in Kenya, both processes share legal and administrative steps to ensure compliance with Kenyan laws.

Church registration legally recognizes your religious organization, allowing it to conduct worship services, own property, enter contracts, and access government support. This formal recognition also enables churches to open bank accounts and engage in community activities.

To register, you must choose a unique church name and conduct a name search. Prepare your church’s constitution or trust deed, provide trustee or leader details including valid identification, and submit proof of physical premises or church address. Registration is done with the Registrar of Societies under the Societies Act or the Ministry of Interior, depending on the structure.

Once all requirements and fees are fulfilled, your church gains legal status. For more information, visit the Registrar of Societies and the eCitizen Portal. Our service guides you through this process efficiently.

How to Register a Company in Kenya: The NileEdge Process

At NileEdge Consultants Ltd, we’ve perfected the process to ensure quick, stress-free company incorporation in Kenya.

Step 1: Business Name Search and Reservation

The first step is verifying if your preferred business name is available and compliant with Kenyan naming rules.

Step 2: Preparation of Registration Documents

Getting these documents right is critical, and NileEdge excel at drafting and reviewing paperwork to meet all statutory requirements.

Step 3: Online Submission on eCitizen

Kenya’s BRS has digitized the company registration process. Applications and payments are submitted online through eCitizen.

Step 4: Receive Certificate of Incorporation

Kenya’s BRS has digitized the company registration process. Applications and payments are submitted online through eCitizen.

Step 5: Tax Registration with Kenya Revenue Authority

NileEdge Consultants provide end-to-end support in these registrations, ensuring compliance and avoiding penalties.

Step 6: Register with Statutory Bodies

National Social Security Fund (NSSF): Mandatory pension contributions for employees National Hospital Insurance Fund.

Post-Registration Requirements and Compliance

Completing company registration in Kenya is just the first step toward running a legally compliant business. Once registered, companies must meet ongoing obligations to remain in good standing with the Registrar of Companies and other regulatory bodies.

These obligations include filing annual returns, holding Annual General Meetings (AGMs), maintaining accurate company minutes, meeting tax filing deadlines, and paying statutory taxes. Any changes in directors or shareholding must also be promptly updated with the Registrar.

Failure to comply with these requirements can result in penalties, loss of good standing, or even deregistration. With NileEdge Consultants’ compliance advisory services, businesses that have completed company registration in Kenya can stay informed on legal changes, meet all filing obligations, and avoid costly non-compliance issues. We ensure you remain compliant year-round so you can focus on growing your business.

Common Challenges in Company Registration in Kenya and How to Overcome Them.

-

Documentation Errors

Incorrect or incomplete applications are a leading cause of registration delays or rejections. Using expert consultants can drastically reduce this risk.

Documentation Errors

Incorrect or incomplete applications are a leading cause of registration delays or rejections. Using expert consultants can drastically reduce this risk. -

Name Conflicts

Many names are already registered or considered offensive. Early professional intervention ensures smooth name reservation.

Name Conflicts

Many names are already registered or considered offensive. Early professional intervention ensures smooth name reservation. -

Lack of Awareness of Regulatory Requirements

Foreign investors may struggle with Kenya’s business laws and tax codes. Consultants like NileEdge provide localized expertise and guidance.

Lack of Awareness of Regulatory Requirements

Foreign investors may struggle with Kenya’s business laws and tax codes. Consultants like NileEdge provide localized expertise and guidance. -

Delays in Tax and Statutory Registrations

Missing registration deadlines can result in fines. Expert services help you navigate these timelines efficiently.

Delays in Tax and Statutory Registrations

Missing registration deadlines can result in fines. Expert services help you navigate these timelines efficiently.

Cost Breakdown of Company Registration in Kenya.

Wondering how much it costs to register a company in Kenya? At NileEdge Consultants Ltd, we believe in full transparency so you can plan your budget with confidence.

The total cost of company registration in Kenya typically depends on factors such as your share capital, government fees, and any additional services you may need. Here’s a general guide to help you understand the typical expenses involved.

These are mandatory charges paid to the Registrar of Companies and KRA, which include:

✅ Name Reservation Fee:

Ksh 150 per name submitted via the eCitizen platform.

✅ Registration Fee (Based on Nominal Share Capital):

For share capital up to Ksh 1 million: approx. Ksh 10,000 - Ksh 12,000.

Above Ksh 1 million, the fee increases based on a tiered scale.

✅ CR12 Processing Fee:

Usually included in overall registration costs.

✅ Stamp Duty:

Currently not charged for company registration under the Companies Act 2015 (unlike in older systems).

These are charges by consultants like NileEdge Consultants Ltd to handle the paperwork, filings, compliance checks, and deliver a hassle-free process.

Our company registration service packages Depends on type which includes:

✅ Name search & reservation

✅ Drafting of Memorandum & Articles of Association (MEMARTS)

✅ Preparation & filing of CR forms

✅ Handling eCitizen submissions

✅ Obtaining the Certificate of Incorporation

✅ Securing the CR12 document

✅ Assistance with company KRA PIN registration

Depending on your needs, you might require additional services such as:

KRA VAT & PAYE Registration: From Ksh 10,500

Business Permit Application: From Ksh 17,500 depending on county and Activity

Trademark Registration: From Ksh 18,000

Company Secretary Appointment: Starts at Ksh 20,000 per year (mandatory for companies with share capital over Ksh 5 million)

Why Choose NileEdge for Your Company Registration in Kenya

Choosing NileEdge for your company registration in Kenya means working with a partner who values transparency, speed, and accuracy. We provide clear invoices with no hidden costs, ensure your paperwork is completed correctly the first time, and offer discounted bundles when you combine registration with KRA, permits, or secretarial services.

Transparent Pricing With No Hidden Costs

At NileEdge, we believe that starting your business should be a straightforward process without financial surprises. That’s why we provide a detailed, itemized invoice upfront so you know exactly what you’re paying for. This ensures complete trust and allows you to plan your budget with confidence, knowing there will be no hidden fees along the way.

Expert, Error-Free Processing

Our experienced team ensures that your company registration in Kenya is completed accurately and in compliance with all legal requirements. We carefully handle every form, document, and submission to prevent costly mistakes or delays. By getting it right the first time, we save you valuable time and help you launch your business faster.

Value-Packed Service Bundles

Instead of juggling multiple providers, you can enjoy all essential business setup services under one roof. We offer affordable packages that combine company registration with services such as KRA PIN application, business permits, and secretarial support. This not only reduces costs but also gives you the convenience of dealing with a single, reliable partner for your compliance and documentation needs.

Other Services We Offer

Frequently Asked Questions About Company Registration in Kenya

Get clear answers to the most common questions about company registration in Kenya, including requirements, costs, timelines, and processes. Learn how to register your business easily and comply with Kenyan laws.

What is company registration in Kenya?

Company registration in Kenya is the legal process of forming a business entity under Kenyan law, allowing the company to operate officially, enter contracts, and protect shareholders’ interests.

What types of companies can I register in Kenya?

You can register several types, including Limited Liability Companies (LLC), Public Limited Companies (PLC), Sole Proprietorships, Partnerships, and Branches of Foreign Companies.

How do I register a company in Kenya?

Company registration in Kenya is done online through the eCitizen portal. You must reserve a company name, submit required forms, provide identification and KRA PINs for directors and shareholders, and pay the registration fee.

How long does company registration in Kenya take?

The process typically takes between 1 to 5 working days once all documents are submitted correctly through the eCitizen portal.

What are the costs involved in company registration in Kenya?

Costs vary depending on company type but generally include a registration fee (starting around Ksh 1,000), name reservation fee, and other statutory fees.

What documents are needed for company registration in Kenya?

Key documents include company name reservation confirmation, Memorandum and Articles of Association, completed CR1, CR2, CR8 forms, copies of IDs, and KRA PINs of directors and shareholders.

Can a foreigner register a company in Kenya?

Yes, foreigners can register companies in Kenya but may require a Kenyan resident director or comply with specific investment regulations.

What is the minimum share capital required for company registration in Kenya?

There is no minimum share capital required by law, but a nominal share capital must be declared during registration.

What happens after successful company registration in Kenya?

After registration, you receive a Certificate of Incorporation, allowing you to legally operate, open bank accounts, and comply with tax registration.

Can I change company details after registration?

Yes, changes to company directors, address, shareholding, or name can be made by filing the appropriate forms with the Registrar of Companies.