Solutions

Church Registration Services in Kenya

Registering a church in Kenya is simple with professional church registration services. We guide religious organizations through legal compliance, documentation, and approval processes, ensuring your church operates legally and smoothly. Benefit from expert advice, faster approvals, and hassle-free registration to establish your church with confidence across Kenya.

Church Registration Services in Kenya by NileEdge Consultants

Establishing a legally recognized church in Kenya is a significant step toward fulfilling your spiritual mission. At NileEdge Consultants, we specialize in guiding religious organizations through the intricate process of church registration under the Societies Act (Cap 108). Our expert team ensures that all legal requirements are met, facilitating a smooth and efficient registration process.

Understanding the Legal Framework for Church Registration in Kenya

The Societies Act (Cap 108)

The Societies Act (Cap 108) is the primary legislation governing the registration and regulation of societies in Kenya, including religious organizations. Under this Act, a society is defined as any club, company, partnership, or association of ten or more persons established in Kenya or having its headquarters or chief place of business in Kenya.

Role of the Registrar of Societies

The Registrar of Societies, appointed under the Societies Act, is responsible for overseeing the registration and regulation of societies in Kenya. This office ensures that societies operate within the legal framework and adhere to the stipulated requirements.

Key Reasons Why a Church Should Be Registered in Kenya

Discover why registering a church in Kenya is essential for legal protection, credibility, and growth. From property ownership to tax benefits and public trust, registration ensures your ministry operates within the law and enjoys nationwide recognition. Learn the top reasons to register today.

✅ Legal Recognition

Registration gives your church official legal status under Kenyan law, allowing it to operate without restrictions and protecting it from closure or penalties for non-compliance.

✅ Property Ownership

A registered church can legally acquire, own, and protect property such as land, buildings, and vehicles in its name, ensuring full legal protection of church assets.

✅ Bank Account Opening

Registration allows your church to open and operate a bank account in its official name, making it easier to manage finances transparently and securely.

✅ Tax Benefits & Exemptions

Registered churches may qualify for certain tax exemptions and benefits, reducing operating costs and ensuring compliance with Kenya Revenue Authority regulations.

✅ Ability to Sign Contracts

Legal registration enables your church to sign contracts, lease property, or enter partnerships with individuals, organizations, and government bodies.

✅ Credibility & Trust

A registered church earns credibility with members, donors, and partners, boosting confidence and encouraging more people to support and participate in its activities.

Requirements for Church Registration in Kenya – Complete Guide

Learn the essential requirements for church registration in Kenya, including name reservation, constitution drafting, leadership details, and member lists. Our detailed guide ensures your church meets legal standards, avoids delays, and secures official recognition. Start your registration process confidently with expert guidance and compliance tips.

You must select a unique name for your church that is not already registered by another religious organization. The name should reflect the church’s mission and identity while complying with Kenya’s naming guidelines for societies. A name search is usually conducted through the Registrar of Societies to confirm availability. It’s advisable to have two or three backup names in case the first choice is unavailable. Once approved, the name is reserved for a set period, during which you must complete the rest of the registration process to secure your church’s official identity.

A church constitution is a formal document outlining the structure, doctrines, and governance of your church. It should clearly state the church’s mission, vision, membership rules, leadership hierarchy, and decision-making processes. The Registrar of Societies requires that this constitution be well-drafted and compliant with the law. It must also address how the church will handle finances, assets, and internal disputes. A strong constitution not only ensures smooth operations but also protects the church from internal conflicts. This document will be submitted along with your registration application for review and approval by the relevant government authorities.

The registration process requires a list of at least ten founding members of the church, all of whom must be Kenyan citizens aged 18 years and above. Their full names, national ID numbers, postal addresses, and signatures must be provided in the application. These individuals will be recognized as the primary members responsible for the church’s establishment and initial leadership. Having a committed group of founding members demonstrates credibility and organizational stability. The list must be accurate, as discrepancies could delay or prevent approval. This requirement ensures the government can verify the legitimacy of the people behind the church.

A list of at least ten founding members is required, and all must be Kenyan citizens aged 18 years or older. Their full names, national identification numbers, and contact details must be included in the application. This list proves that the church has a real, committed congregation and is not simply a personal or informal group. Members should be active participants in the church’s mission and governance. Providing accurate, verifiable information ensures smoother processing and protects against allegations of misrepresentation. It also establishes the foundation for the church’s membership records, which will be important for future governance.

A valid and verifiable physical address for the church is mandatory for registration. This includes the plot number, street name, and postal address. If the church does not yet own property, a signed lease or tenancy agreement showing lawful occupancy is acceptable. This address will serve as the official location for correspondence and inspections by government authorities. Providing a clear and accurate address enhances transparency and compliance. Inaccurate or false address details can lead to rejection of your application or future legal complications, making it vital to ensure that the location is genuine and properly documented.

Each proposed church official must obtain a Certificate of Good Conduct from the National Police Service. This is a legal requirement under Section 23 of the Societies Act to ensure that leaders have no criminal background that could jeopardize the integrity of the organization. The process involves fingerprinting and a background check. These certificates not only meet compliance standards but also help build public trust in your church’s leadership. Since processing can take time, it’s advisable to apply for these certificates early to prevent delays in your church registration application.

The church must provide details of its leadership structure, including the names, roles, and responsibilities of the officials, such as the pastor, secretary, treasurer, and other key leaders. This information should align with the governance framework outlined in the church’s constitution. Leadership details help the Registrar of Societies assess the organization’s management capacity and accountability measures. Each leader’s contact information and national ID number must be included. Clearly defined leadership roles prevent administrative confusion and establish a chain of command, which is vital for smooth operations, especially when dealing with finances, membership issues, and legal obligations.

Tax Compliance Certificates or tax exemption certificates from the Kenya Revenue Authority (KRA) are required for each official. This confirms that leaders are in good standing with their tax obligations. For religious organizations, tax exemption may apply, but proper documentation is essential to claim it. This requirement ensures financial accountability and prevents future disputes with tax authorities. Even if the church qualifies for exemption, individual officials must still meet their personal tax obligations. Obtaining these certificates in advance helps streamline the application process and demonstrates a commitment to operating transparently within the law.

To complete the registration, you must fill out the official church registration application form from the Registrar of Societies. All required sections must be accurately completed, and the form must be signed by the designated church leaders. A non-refundable registration fee is also payable at the time of submission. The amount may vary, so it’s important to confirm the latest charges from the Registrar’s office. Incomplete forms or failure to pay the required fee will result in delays. Submitting correctly filled forms and proof of payment ensures your application is processed promptly and without unnecessary setbacks.

Complete Church Registration Process in Kenya – Step-by-Step Guide for Religious Organizations

Learn the full church registration process in Kenya with our step-by-step guide. From name search and constitution drafting to approvals, compliance, and documentation, we make the process simple and clear. Get expert tips, legal requirements, and all you need to register a church in Kenya successfully and lawfully.

Step 1: Name Search and Reservation

Submit at least three unique church names to the Registrar of Societies. A name search will confirm availability and ensure your name is not already in use or too similar to another organization. This step protects your church’s identity and brand from legal conflicts and sets the foundation for official registration.

Step 2: Draft the Church Constitution

Prepare a comprehensive constitution outlining the church’s objectives, governance structure, membership rules, financial management, and operational procedures. It should align with the Societies Act and be signed by founding members. This document serves as the church’s legal framework and is mandatory for approval.

Step 3: Provide List of Officials and Founding Members

List key officials such as the chairman, secretary, and treasurer with their full names, national ID numbers, postal addresses, emails, and phone numbers. Also include a membership list of at least ten Kenyan citizens aged 18 and above. This proves the church’s legitimacy and organizational structure.

Step 4: Obtain Certificates of Good Conduct

All proposed officials must acquire Certificates of Good Conduct from the National Police Service. This ensures the leadership team has no criminal background, reinforcing credibility and compliance with Section 23 of the Societies Act.

Step 5: Acquire KRA Tax Compliance or Exemption Certificates

Each official must provide a Tax Compliance Certificate or tax exemption certificate from the Kenya Revenue Authority. This shows good standing with tax laws and financial accountability, even if the church qualifies for tax exemptions as a religious organization.

Step 6: Prepare Affidavits by Officials

Officials must swear affidavits before a Commissioner for Oaths declaring whether they are members or officers of other religious societies. This prevents leadership conflicts and promotes transparency in church governance.

Step 6: Secure and Provide a Physical Address

Give the official church address, including plot number, road, town, and county. If renting, include a valid lease agreement or property owner’s consent letter. The physical address is essential for inspections, correspondence, and government records.

Step 6: Obtain a Recommendation Letter

Secure an introduction or recommendation letter from an existing registered religious society in good standing. This must be signed by at least two of its officers and demonstrates your church’s credibility and recognition within the religious community.

Step 6: Complete the Application and Submit to Registrar of Societies

Fill out the official application form, attach all required documents, and pay the applicable registration fee. Submit your package to the Registrar of Societies and await processing. If approved, you’ll receive a Certificate of Registration confirming your church’s legal status in Kenya.

Post-Registration Obligations for Churches in Kenya

Once your church is successfully registered under the Societies Act, certain legal and administrative duties must be followed to maintain compliance and good standing with the Registrar of Societies and other government bodies. Failure to meet these obligations can lead to fines, penalties, or even deregistration. Below are the key post-registration responsibilities every church in Kenya must observe:

Maintain Accurate Records

A registered church is legally required to keep detailed and up-to-date records of its activities. This includes minutes of meetings, membership registers, financial statements, receipts, and expenditures. Accurate record-keeping ensures transparency, facilitates smooth audits, and helps the church make informed decisions. These records may be requested by the Registrar of Societies or other authorities for verification at any time. Proper documentation also builds trust with members, donors, and partners by demonstrating accountability and responsible stewardship of church resources.

File Annual Returns

Every registered church must submit annual returns to the Registrar of Societies within the stipulated deadline, usually at the end of each financial year. These returns should include updated details of church officials, a report of activities carried out during the year, and financial summaries. Filing annual returns is a legal requirement under the Societies Act and confirms that the church is active and compliant. Failure to file on time can attract penalties, suspension, or deregistration. Many churches set up internal compliance calendars to ensure they never miss this obligation.

Comply with Tax Obligations

Although many churches in Kenya qualify for tax exemption on certain income, they are still required to comply with applicable tax laws. This includes remitting Pay As You Earn (PAYE) for employees, withholding tax on certain payments, and accounting for VAT where applicable. Churches must obtain and maintain a KRA PIN for official transactions. Non-compliance can result in audits, back taxes, and penalties. Even tax-exempt religious organizations should file nil returns annually to remain in good standing with the Kenya Revenue Authority.

Adhere to Employment Laws

If a church hires staff — whether clergy, administrative personnel, or other workers — it must follow Kenyan labor laws. This includes issuing employment contracts, paying at least the statutory minimum wage, remitting National Social Security Fund (NSSF) and National Hospital Insurance Fund (NHIF) contributions, and providing leave entitlements. Compliance ensures that the church operates as a responsible employer and avoids legal disputes, fines, or damage to its reputation. Good employment practices also help attract and retain skilled staff who are essential to the church’s mission.

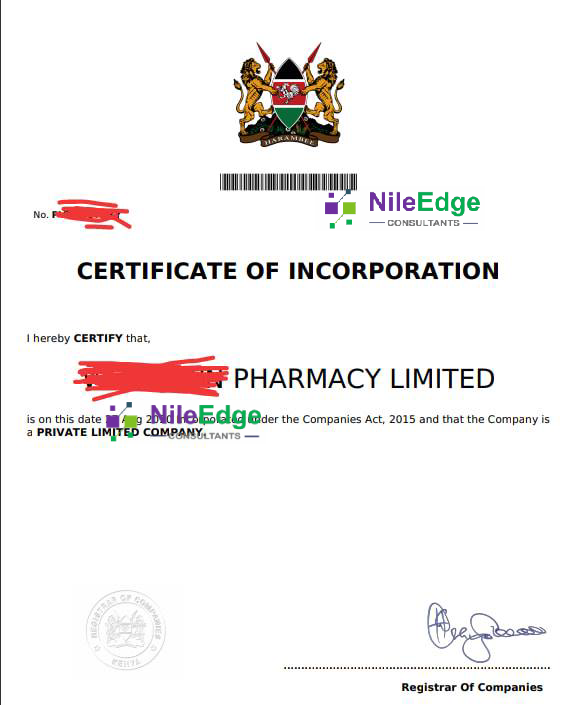

Display the Certificate of Registration

The church’s Certificate of Registration must be prominently displayed at its premises, ideally in the main office or reception area. This not only complies with legal requirements but also reassures members, visitors, and government officials that the church is officially recognized. Displaying the certificate enhances the church’s credibility and demonstrates transparency in its operations. If the certificate is lost or damaged, the church should apply for a replacement from the Registrar of Societies immediately to maintain compliance.

Common Challenges in Church Registration in Kenya and How to Overcome Them.

While the church registration process in Kenya is straightforward on paper, many applicants encounter delays or rejections due to common mistakes or overlooked requirements. Understanding these challenges in advance can save time, reduce costs, and improve the chances of quick approval from the Registrar of Societies.

-

Rejection Due to Similar or Conflicting Names

One of the most frequent issues is selecting a church name that is already registered or too similar to an existing religious organization. This leads to rejection during the name search stage. To avoid this, applicants should propose at least three unique, meaningful names that comply with naming guidelines under the Societies Act.

-

Incomplete or Non-Compliant Constitution

A poorly drafted church constitution that lacks clarity, omits mandatory sections, or fails to align with legal requirements is a major cause of delays. Since the constitution forms the legal backbone of the church, it must include governance structure, financial management rules, and doctrinal statements. Many churches hire professionals to ensure accuracy.

-

Missing or Inaccurate Member Information

Providing incomplete or incorrect details for officials or members — such as mismatched ID numbers, missing contacts, or unverified citizenship — can result in the application being returned. This issue is common where applicants rush the process without verifying all personal data beforehand.

-

Delays in Obtaining Certificates of Good Conduct

Certificates of Good Conduct from the National Police Service can take several weeks to process. Churches that apply for these documents late often face registration delays, as applications cannot be submitted without them. Early application is highly recommended.

-

Tax Compliance Issues

If officials do not have KRA Tax Compliance Certificates or have unresolved tax obligations, the registration process may be halted. Even churches eligible for tax exemptions must submit the proper documentation to prove compliance with the Kenya Revenue Authority.

-

Lack of a Valid Physical Address

Providing a temporary, unverifiable, or inaccurate physical address is another common pitfall. The Registrar of Societies requires a clear, lawful address for correspondence and inspection. Failure to provide this can cause long delays or outright rejection.

Cost of Church Registration in Kenya

Understanding the cost of church registration in Kenya is essential for planning and budgeting before starting the process. Fees may vary depending on the type of church, documentation, and whether professional assistance is used.

The primary cost is the official registration fee payable to the Registrar of Societies. This fee covers the processing of your application and issuance of the Certificate of Registration. It is typically a one-time, non-refundable payment. The exact amount can vary, so it’s important to confirm the latest fee schedule from the Registrar’s office.

Many churches hire legal or professional services to draft constitutions, affidavits, and other documents. These fees depend on the complexity of the church structure and the professional rates charged. While optional, professional assistance can help avoid mistakes that may delay approval.

The primary cost is the official registration fee payable to the Registrar of Societies. This fee covers the processing of your application and issuance of the Certificate of Registration. It is typically a one-time, non-refundable payment. The exact amount can vary, so it’s important to confirm the latest fee schedule from the Registrar’s office.

Although some churches may qualify for exemptions, there may be minor administrative fees when obtaining KRA Tax Compliance Certificates for each official.

Additional costs may include:

Notary or Commissioner for Oaths fees for affidavits

Photocopying and documentation fees

Recommendation letters if professional assistance is required

By budgeting for these costs upfront, churches can ensure a smoother registration process without unexpected delays or financial strain.

Why Choose NileEdge Consultants for Church Registration.

Registering a church in Kenya can be complex due to legal requirements, documentation, and compliance with the Societies Act. NileEdge Consultants provides professional church registration services in Kenya, ensuring a smooth, efficient, and legally compliant process for religious organizations.

Our team has extensive experience in providing church registration services in Kenya, understanding all statutory requirements, processes, and documentation. We guide you through the steps, ensuring your church application meets government standards and minimizing the risk of delays or rejection.

From conducting name searches and drafting constitutions to submitting documents and advising on post-registration compliance, NileEdge Consultants handles every aspect of the church registration process in Kenya. Our end-to-end services save you time and ensure accuracy at every step.

By leveraging our experience in church registration services in Kenya, we help avoid common mistakes that can cause delays or unnecessary expenses. Our streamlined approach ensures that your church registration is completed efficiently, saving you both time and money.

We provide customized guidance tailored to your church’s unique needs, including advice on leadership structure, membership documentation, and legal compliance. With NileEdge Consultants, you receive hands-on support throughout the church registration process in Kenya.

NileEdge Consultants has a strong reputation for successfully assisting churches and religious organizations across Kenya. Our clients benefit from our credibility, professionalism, and proven track record in offering church registration services in Kenya.

We don’t stop at registration. Our church registration services in Kenya include advising on post-registration obligations such as maintaining accurate records, filing annual returns, tax compliance, employment laws, and displaying the registration certificate, keeping your church in full legal standing.

Other Services We Offer

Frequently Asked Questions About Church Registration Services in Kenya

Get answers to the most common questions about church registration in Kenya. Learn about requirements, processes, costs, post-registration obligations, and legal compliance. Our detailed FAQ helps churches understand how to register efficiently, avoid delays, and meet all statutory requirements under the Societies Act.

What is the process of registering a church in Kenya?

The process involves conducting a name search, drafting a church constitution, listing officials and members, obtaining certificates of good conduct and tax compliance, securing a physical address, and submitting the application to the Registrar of Societies. NileEdge Consultants can guide you through each step for smooth approval.

How long does it take to register a church in Kenya?

On average, the church registration process in Kenya can take 4 to 8 weeks, depending on the completeness of documents, background checks, and government processing times. Using professional church registration services in Kenya can significantly reduce delays.

What are the key requirements for church registration in Kenya?

Requirements include a unique church name, a detailed constitution, a list of officials and at least ten members, a verifiable physical address, certificates of good conduct for officials, KRA tax compliance certificates, affidavits, and a recommendation letter from a registered religious society.

Can a foreigner register a church in Kenya?

Yes, but at least the majority of officials and members must be Kenyan citizens. Foreigners may participate in church activities, but legal registration requires compliance with Kenyan laws, including local leadership and residency rules.

Are there post-registration obligations for churches in Kenya?

Yes. Registered churches must maintain accurate records, file annual returns with the Registrar of Societies, comply with tax regulations, adhere to employment laws, and display the Certificate of Registration. Non-compliance can lead to penalties or deregistration.

How much does it cost to register a church in Kenya?

The cost varies depending on official fees, professional services, certificates of good conduct, and other administrative expenses. On average, registration can range from KSh 15,000 to KSh 50,000, depending on whether professional assistance is used.

Why is a recommendation letter required for church registration?

A recommendation letter from a registered religious society demonstrates credibility and confirms that your church is recognized within the religious community. It is a legal requirement under the Societies Act and helps the Registrar of Societies verify authenticity.

What are common challenges in church registration in Kenya?

Challenges include name conflicts, incomplete or non-compliant constitutions, missing member information, delays in obtaining certificates of good conduct, tax compliance issues, and providing an invalid physical address. Using professional church registration services in Kenya can help overcome these obstacles.

Can a church operate legally in Kenya without registration?

No. Operating a church without registration is illegal and may result in closure, fines, or legal action. Registration ensures your church is recognized under the law, can own property, open bank accounts, and enjoy credibility with members and partners.

Why should I use NileEdge Consultants for church registration in Kenya?

NileEdge Consultants provides expert church registration services in Kenya, guiding you through legal requirements, documentation, post-registration compliance, and minimizing delays. Our comprehensive support ensures your church is registered efficiently, legally compliant, and positioned for long-term credibility and success.