Solutions

NGO Registration Services in Kenya

Expert NGO registration services in Kenya. Nileedge Consultants ensures smooth, legal, and hassle-free registration, helping your organization comply with all regulatory requirements efficiently

Table of Contents

Non-Profit Registration Services Kenya

Registering a Non-Governmental Organization (NGO) in Kenya is a crucial step for individuals or groups looking to engage in charitable, humanitarian, or advocacy work. NGOs operate independently from the government and play a vital role in areas such as education, healthcare, environmental conservation, and human rights.

Kenya has a well-defined legal framework for NGO registration, governed by the NGO Coordination Act (1990). All NGOs must be registered with the NGO Coordination Board, which regulates their operations to ensure transparency, accountability, and compliance with the law.

What is an NGO?

A Non-Governmental Organization (NGO) is an independent, non-profit entity that operates outside government control to address social, humanitarian, environmental, or developmental issues. NGOs play a crucial role in advocacy, service delivery, and policy influence, often focusing on sectors such as healthcare, education, human rights, poverty alleviation, and environmental conservation.

Key Characteristics of an NGO

- Non-Profit Nature – NGOs do not distribute profits to members but reinvest them into their causes.

- Independent Governance – NGOs operate independently from government influence.

- Public Benefit Mission – They work towards community development, social justice, and humanitarian aid.

- Funding from Grants & Donations – NGOs rely on funding from individual donors, foundations, and international agencies.

Types of NGOs

- International NGOs (INGOs) – Operate across multiple countries (e.g., Red Cross, Amnesty International).

- National NGOs – Registered within a specific country and operate nationwide.

- Community-Based Organizations (CBOs) – Focus on grassroots initiatives within a local community.

- Faith-Based Organizations (FBOs) – NGOs affiliated with religious institutions addressing social issues.

- Advocacy NGOs – Focus on policy change, legal rights, and public awareness campaigns.

- Operational NGOs – Implement direct projects such as disaster relief, education, or healthcare programs.

Role of NGOs in Kenya

NGOs in Kenya contribute significantly to social welfare, economic development, and governance. They work alongside government agencies, private sector players, and international organizations to implement projects that improve livelihoods, human rights, and environmental sustainability.

Why Register an NGO in Kenya?

Registering a Non-Governmental Organization (NGO) in Kenya offers numerous benefits, including legal recognition, access to funding, tax exemptions, and credibility. NGOs play a vital role in community development, advocacy, and humanitarian aid, making proper registration essential for smooth operations and compliance with Kenyan laws.

Legal Recognition & Compliance

A registered NGO is a legally recognized entity under the NGO Coordination Act (1990). This allows it to: Operate within Kenya without legal restrictions. Sign agreements with government agencies and private organizations. Open a corporate bank account in the organization’s name.

Access to Local & International Funding

Many donors, both local and international, require NGOs to be officially registered before providing grants or funding. Registered NGOs can: Apply for grants from international donors, government funds, and private foundations. Partner with other organizations and participate in global development programs.

Tax Exemptions & Duty-Free Benefits

Registered NGOs in Kenya can apply for tax exemptions under the Kenya Revenue Authority (KRA), which may include: Exemption from corporate income tax. Duty-free importation of essential goods (e.g., medical supplies, educational materials).

Credibility & Public Trust

A registered NGO gains trust and credibility among: Government authorities, ensuring smooth operations and compliance. Donors and sponsors, who prefer working with registered organizations. Beneficiaries and volunteers, who feel secure engaging with a legally recognized entity.

Ability to Open a Corporate Bank Account

Most banks in Kenya require an NGO to be officially registered before opening a bank account. A corporate account helps with: Transparent financial management and accountability. Accepting donations and grants securely. Managing payroll and operational expenses efficiently.

Protection of Members & Assets

Registering an NGO establishes it as a separate legal entity, which means: Members and founders are protected from personal liability in case of lawsuits. The NGO can own property, sign contracts, and take legal action in its name.

Opportunity for Local & International Partnerships

A registered NGO can collaborate with: Government agencies to implement community projects. United Nations (UN) agencies and international NGOs for global impact. Corporate organizations for funding, sponsorships, and corporate social responsibility (CSR) partnerships.

Requirements for NGO Registration in Kenya

Registering a Non-Governmental Organization (NGO) in Kenya involves meeting specific legal, documentation, and compliance requirements as outlined by the NGO Coordination Act (1990). Below is a detailed breakdown of the necessary documents, eligibility criteria, and compliance requirements to successfully register an NGO in Kenya.

The first step in NGO registration in Kenya is reserving and getting approval for your organization’s name. The NGO Coordination Board requires that the chosen name be unique and not too similar to existing organizations or government bodies. You must submit at least three name options in order of preference, and the Board will conduct a search to ensure no duplication or conflict. This process helps prevent confusion and brand misuse. A reserved name is valid for 90 days, during which you should complete your application. Choosing a name that reflects your mission and values can make a strong impression on donors and stakeholders. For best results, ensure the name is short, easy to pronounce, and relevant to your NGO’s purpose. Name approval is an essential legal requirement that lays the foundation for your organization’s identity and official recognition in Kenya. Without it, you cannot proceed to other stages of registration.

A well-drafted constitution is a critical requirement for NGO registration in Kenya. This document outlines the rules, objectives, and governance structure of your organization. It must clearly state the NGO’s name, registered office, vision, mission, membership criteria, decision-making processes, and procedures for electing officials. The constitution also defines how funds will be managed, how meetings will be conducted, and how amendments can be made. It serves as the organization’s legal framework, guiding both operations and dispute resolution. The NGO Coordination Board requires that the constitution be signed by at least three founder members, with their full details included. A strong constitution not only meets legal requirements but also builds credibility with donors, partners, and regulatory authorities. If poorly written, it can cause operational and legal challenges in the future. Therefore, seeking professional help when drafting your constitution can ensure compliance with Kenyan laws and international best practices.

For NGO registration in Kenya, you must have a minimum number of founding members. The NGO Coordination Board requires at least three members, all of whom must be over 18 years old. At least one-third of these members should be Kenyan citizens. Each founding member is required to provide a copy of their national ID or passport, recent passport-sized photographs, and personal contact details. This requirement ensures that the NGO is formed by a genuine group of individuals committed to its objectives rather than a single person. The diversity among founders can also strengthen governance, as different perspectives contribute to better decision-making. Founding members must also be free from any legal disqualifications, such as bankruptcy or criminal convictions involving fraud or dishonesty. By fulfilling this requirement, your NGO demonstrates legitimacy and commitment to collaborative leadership, which increases trust among stakeholders and government authorities during the registration process.

A registered office address is a mandatory requirement for NGO registration in Kenya. The NGO Coordination Board needs to know the physical location where your organization will operate. This location should be accessible and suitable for conducting official business, storing records, and holding meetings. You will be required to submit proof of address, such as a tenancy agreement, utility bill, or title deed in the NGO’s name or the landlord’s name with a consent letter. The physical office is important because it acts as the official contact point for correspondence from government authorities, donors, and the public. It also demonstrates that your NGO has a legitimate operational base. Even if you plan to operate in multiple regions, the registered office will remain your primary point of contact. Having a verifiable address also increases your organization’s credibility and ensures compliance with Kenya’s legal requirements for non-governmental entities.

When applying for NGO registration in Kenya, you must provide a clear and detailed statement of objectives. This section outlines the specific purpose and scope of your organization’s activities. The objectives should align with charitable, humanitarian, or community development goals and must not conflict with Kenyan laws or public policy. For example, your objectives might include promoting education, improving healthcare access, protecting the environment, or supporting vulnerable communities. The NGO Coordination Board reviews these objectives carefully to ensure that your organization’s mission is genuine and socially beneficial. A well-defined statement of objectives also helps donors, partners, and volunteers understand your focus areas. This requirement is crucial because vague or overly broad objectives may lead to delays or rejection of your application. To avoid such issues, ensure that your objectives are specific, measurable, and realistic while leaving room for future growth and expansion of your NGO’s impact.

Before registering an NGO in Kenya, you must demonstrate a commitment to financial transparency and tax compliance. Although NGOs are generally non-profit, they still need to comply with Kenya Revenue Authority (KRA) regulations. You may need to apply for a Personal Identification Number (PIN) for the organization and maintain proper financial records. If your NGO plans to import goods, apply for grants, or run income-generating activities, having a tax-compliant status is essential. The NGO Coordination Board may request proof of your financial management systems, including bank account details in the NGO’s name. Proper financial accountability not only meets legal requirements but also builds trust with donors and partners. Failure to maintain tax compliance can lead to penalties, loss of funding opportunities, or deregistration. Therefore, from the outset, it’s important to put in place clear accounting procedures and consider professional bookkeeping support for your NGO.

The final requirement for NGO registration in Kenya is the submission of completed application forms and all necessary supporting documents. The NGO Coordination Board provides specific forms that must be filled accurately and signed by the founders. Commonly required documents include copies of the approved name search, signed constitution, passport photos, copies of ID or passports for all officials, proof of registered office, and a list of officials with their details. Some applications may also require a recommendation letter from relevant government departments, especially for sector-specific NGOs like health or education. Accuracy and completeness are critical because missing or incorrect information can delay the registration process. Once submitted, the Board reviews your application and may request clarifications. Having all documents well-prepared not only speeds up approval but also shows professionalism and readiness to operate as a legally recognized NGO in Kenya.

Step-by-Step Process of NGO Registration in Kenya

Registering an NGO in Kenya involves several structured steps, ensuring compliance with the NGO Coordination Act (1990). Below is a detailed guide on the NGO registration process, including key stages from name reservation to final approval and certification

Step 1: Name Search and Reservation

The first step is to submit at least three proposed names to the NGO Coordination Board for approval. The names must be unique, relevant to your mission, and not similar to existing organizations. Once approved, the name is reserved for 90 days, allowing you to prepare the rest of the documentation.

Step 2: Drafting the NGO Constitution

Your NGO must have a comprehensive constitution outlining its objectives, governance structure, membership rules, meeting procedures, and financial management guidelines. This document acts as your organization’s legal foundation and must be signed by all founding members.

Step 3: Preparing Required Documentation

You will need to gather and prepare all necessary documents, including: Certified copies of ID or passports for all officials. Two passport-sized photographs of each official. Proof of the registered office address (tenancy agreement, utility bill, or title deed). A detailed statement of objectives.

Step 4: Meeting Membership Requirements

At least three founding members are required, with one-third being Kenyan citizens. All members must be over 18 years old and legally capable of holding office.

Step 5: Submitting the Application to the NGO Coordination Board

Once all documents are ready, complete the official application forms provided by the NGO Coordination Board. Submit them alongside your supporting documents and pay the prescribed application fee.

Step 6: Vetting and Approval Process

The Board reviews your application to ensure compliance with the law. This may involve background checks, verification of your objectives, and confirming the legitimacy of your operations. In some cases, additional clarifications or supporting documents may be requested.

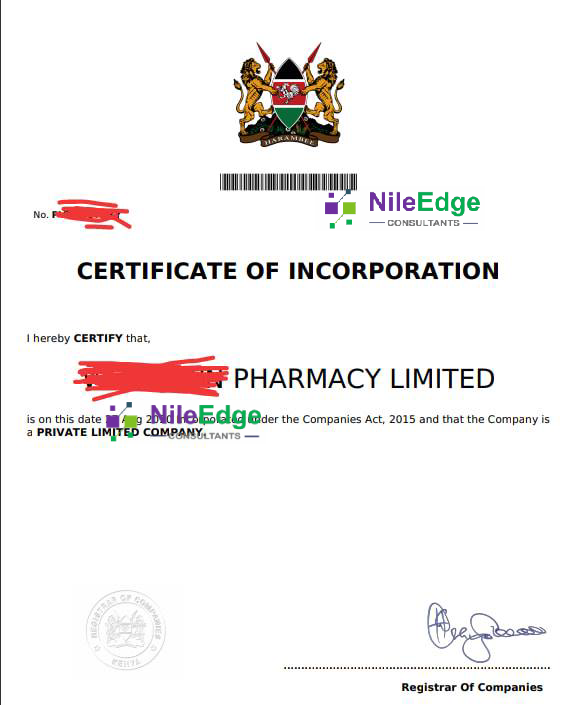

7. Issuance of the NGO Registration Certificate

If your application meets all requirements, the Board will issue a Certificate of Registration. This legal document authorizes your NGO to operate in Kenya and engage in approved activities.

✅ This process can be time-consuming if not handled carefully. Many organizations choose professional assistance from Nileedge Consultants to ensure faster approval, full compliance, and error-free applications.

Costs and Timelines for NGO Registration in Kenya

Registering an NGO in Kenya involves specific fees and processing timelines, depending on whether the organization is local or international. Below is a breakdown of the registration fees and expected timelines for approval.

NGO Registration Fees in Kenya

NGO Registration Fees in Kenya

The NGO Coordination Board charges a non-refundable registration fee, which varies based on the type of NGO:

Local NGO Registration Fee – KES 16,000

International NGO Registration Fee – KES 30,000

Additional optional fees may apply:

Name Reservation Fee – KES 1,000

Certificate Replacement Fee – KES 2,000 (if lost or damaged)

Annual Compliance Filing Fee – Varies depending on NGO size

Processing Time for NGO Registration

Processing Time for NGO Registration

The total time required to complete the NGO registration process depends on document accuracy and compliance with legal requirements. Below is the typical timeline:

1. Name Search & Reservation

1. Name Search & Reservation

2. Drafting & Submitting Registration Documents

2. Drafting & Submitting Registration Documents

3. NGO Coordination Board Review & Approval

3. NGO Coordination Board Review & Approval

4. Issuance of NGO Registration Certificate

4. Issuance of NGO Registration Certificate

Common Challenges in NGO Registration in Kenya and How to Overcome Them.

Registering an NGO in Kenya can be a complex process due to legal, compliance, and procedural challenges. Below are the most common issues applicants face and how to overcome them for a smooth registration process.

Common Reasons for Rejection:

Common Reasons for Rejection:

Incomplete or Incorrect Documentation – Missing or inaccurate details in submitted forms.

Non-Compliant NGO Name – Chosen name conflicts with existing organizations or lacks approval.

Unclear Objectives – Vague or politically inclined objectives that do not align with NGO standards.

Failure to Meet Membership Requirements – Not having the minimum required board members.

How to Avoid This Issue:

How to Avoid This Issue:

Double-check all required documents before submission.

Choose at least three unique and relevant NGO names for approval.

Clearly define mission, vision, and objectives to align with NGO Coordination Board requirements.

Ensure you meet the minimum membership requirement (at least three founding members).

Common Compliance Challenges:

Common Compliance Challenges:

Failure to Submit Annual Returns – NGOs must file financial and activity reports annually.

Non-Adherence to NGO Coordination Act – Operating outside the registered mandate.

Tax Compliance Issues – NGOs seeking tax exemptions must register with the Kenya Revenue Authority (KRA).

How to Maintain Compliance:

How to Maintain Compliance:

File annual financial statements and reports on time.

Ensure that all activities align with the approved objectives in the NGO Constitution.

Apply for tax exemption status and maintain KRA compliance.

Common Causes of Delays:

Common Causes of Delays:

Backlog at the NGO Coordination Board – High application volumes can slow down approvals.

Errors in Documentation – Incomplete or inaccurate submissions lead to rejections and reapplication.

Additional Vetting for International NGOs – Foreign-based NGOs may require more scrutiny.

How to Speed Up the Process:

How to Speed Up the Process:

Ensure all registration forms and documents are accurate before submission.

Follow up with the NGO Coordination Board to track progress.

Seek professional assistance to ensure compliance and avoid unnecessary delays.

Maintaining NGO Compliance in Kenya

Once an NGO is registered in Kenya, it must adhere to legal and financial compliance requirements to maintain its status. Below is a detailed guide on annual returns, tax obligations, and audit requirements to ensure smooth operations.

1. Annual Returns

What Are Annual Returns?

What Are Annual Returns?

Annual returns are mandatory reports that NGOs must submit to the NGO Coordination Board to show compliance with regulations.

Key Requirements for Filing Annual Returns:

Key Requirements for Filing Annual Returns:

Annual Activity Report – Summary of the NGO’s achievements and projects.

Audited Financial Statements – Certified by a registered auditor.

Updated Board Member List – Any changes to leadership or governance must be reported.

Compliance Fee – Payment of KES 2,000 for local NGOs and KES 4,000 for international NGOs.

Filing Deadline:

NGOs must submit annual returns within three (3) months after the end of the financial year.

Non-Compliance Consequences:

Late filing penalties or de-registration by the NGO Coordination Board.

Restrictions on funding access from donors.

2. Tax Obligations

Are NGOs Tax-Exempt in Kenya?

Are NGOs Tax-Exempt in Kenya?

NGOs are not automatically tax-exempt and must apply for tax exemption status from the Kenya Revenue Authority (KRA).

How to Apply for Tax Exemption:

Submit an application to KRA through the NGO Coordination Board.

Provide certified financial statements and proof of charitable activities.

Receive a Tax Exemption Certificate, valid for 5 years (renewable).

3. Audits & Financial Reporting

Why Are Audits Important?

Why Are Audits Important?

NGOs must conduct annual audits to ensure financial transparency and donor confidence.

Key Audit & Reporting Requirements:

Key Audit & Reporting Requirements:

Hire a Certified Public Accountant (CPA) to conduct audits.

Submit audited accounts along with annual returns.

Maintain proper financial records to track funding and expenditures.

Ensure Full Compliance with NileEdge

Why Choose NileEdge for Your NGO Registration in Kenya

Registering and managing an NGO in Kenya requires expert guidance to ensure compliance with legal requirements. At NileEdge, we offer comprehensive NGO registration and compliance services, making the process fast, efficient, and hassle-free.

Expert Consultation

✅ In-Depth Knowledge of NGO Laws – Our team understands the NGO Coordination Act and all compliance requirements.

✅ Personalized Guidance – We assess your NGO’s objectives and recommend the best structure for registration.

✅ Document Review & Preparation – Ensuring all required documents are complete and error-free before submission.

✅ Advisory on Tax Exemption & Compliance – Helping NGOs secure tax-exempt status with the Kenya Revenue Authority (KRA).

We eliminate guesswork, ensuring your NGO is set up the right way from the start!

Fast-Track Registration Services

🚀 Accelerated Name Search & Reservation – Get your NGO name approved quickly.

🚀 Seamless Application Submission – We handle all paperwork, ensuring compliance with the NGO Coordination Board.

🚀 Priority Follow-Ups – We track your application status and resolve any issues that may cause delays.

🚀 Guaranteed Approval Assistance – Minimize the risk of application rejection due to errors or missing documents.

📌 We streamline the process to help you launch your NGO in the shortest time possible!

Ongoing Compliance Support

✅ Annual Returns Filing – Ensuring your NGO meets all regulatory requirements on time.

✅ Financial Reporting & Audits – Helping you prepare audited financial statements for compliance and donor trust.

✅ Board & Governance Advisory – Keeping your organization compliant with leadership and reporting obligations.

✅ Renewals & Tax Exemption Assistance – Handling applications for KRA tax exemption certificates and renewals.

📌 We don’t just register your NGO—we help you stay compliant for long-term success!

Other Services We Offer

Frequently Asked Questions About NGO Registration in Kenya

Find comprehensive answers to frequently asked questions about NGO registration in Kenya. Discover the requirements, step-by-step process, costs, timelines, and compliance guidelines to help you register your NGO smoothly, legally, and efficiently, ensuring full adherence to the NGO Coordination Act and building a strong foundation for your organization’s success

What is an NGO, and how is it different from a CBO or Trust?

- NGO (Non-Governmental Organization) – A legally registered organization that operates for charitable, social, religious, or educational purposes at a national or international level.

- CBO (Community-Based Organization) – A small, grassroots organization that serves a specific community at the local level.

- Trust/Foundation – A non-profit legal entity focused on grant-making, funding, or charitable projects with appointed trustees.

Who is eligible to register an NGO in Kenya?

Any Kenyan citizen or foreign national can register an NGO, provided they meet the membership and governance requirements.

The NGO must have at least three founding members with a clear mission and objectives.

Foreign applicants must provide a work permit or letter of approval from the relevant authorities.

How long does it take to register an NGO in Kenya?

The full registration process takes approximately 2–3 months, including:

Name reservation: 2–5 working days

Document preparation & submission: 1–2 weeks

Review & approval by NGO Coordination Board: 3–6 weeks

Issuance of the NGO Registration Certificate: 2–3 months

What documents are required for NGO registration?

Three (3) proposed NGO names for approval

Duly completed registration forms (Form 1, Form 3, Form 4)

Signed Constitution outlining the NGO’s objectives

List of Board Members with their IDs, PIN certificates, and residential addresses

Minutes of the first board meeting (signed)

One-year work plan & budget

Source of funding declaration

Passport-size photos of directors

Non-refundable registration fee (KES 16,000 for local NGOs, KES 30,000 for international NGOs)

What are the costs associated with NGO registration?

Local NGO Registration Fee – KES 16,000

International NGO Registration Fee – KES 30,000

Name Reservation Fee – KES 1,000

Certificate Replacement Fee – KES 2,000 (if lost)

Annual Compliance Filing Fee – KES 2,000 for local NGOs, KES 4,000 for international NGOs

Are NGOs in Kenya tax-exempt?

No, NGOs are not automatically tax-exempt. To obtain tax exemption, NGOs must:

Apply for a Tax Exemption Certificate from the Kenya Revenue Authority (KRA).

Provide financial statements proving charitable or non-profit status.

Renew the exemption every 5 years.

Can a foreigner register an NGO in Kenya?

Yes, foreign nationals can register an NGO in Kenya. However, they must:

Provide a copy of their passport.

Submit a valid work permit or a letter of special approval.

Ensure that at least one Kenyan is on the board of directors.

What are the ongoing compliance requirements for NGOs?

To remain compliant, an NGO must:

File annual returns with the NGO Coordination Board.

Submit audited financial statements from a certified accountant.

Report any changes in leadership, constitution, or operations.

Renew tax exemption certificates (if applicable).

What happens if my NGO registration is rejected?

If your NGO application is rejected, the NGO Coordination Board will provide reasons for the rejection. Common reasons include:

Incomplete documentation

Non-compliant NGO name

Lack of clear objectives

Failure to meet board member requirements

How can NileEdge help with NGO registration?

At NileEdge, we offer:

Full NGO registration services – from name search to certification.

Fast-tracking of applications – ensuring quick approval.

Compliance support – including annual returns, audits, and tax exemption.

Legal & governance advisory – helping NGOs maintain regulatory compliance.